WHICH BANK WILL TAKE THE LEAD IN FRAUD PREVENTION BY BEING THE FIRST TO PROVIDE THE SAFE DEPOSIT BOX FOR DATA® TO ITS CUSTOMERS?

Chase, Bank of America, Credit Suisse, HSBC? Or, Some Upstart?

(July 22, 2020 – New York, NY) – On August 3, the first Safe Deposit Box for Data® will hit the market, initially allowing a single bank to offer its customers a revolutionary, un-hackable new way to store and share financial data, protect private information, and provide foolproof data security before making it available to the entire banking industry.

But which one of the top ten global banks will it be?

Or – will some quicker, bolder upstart scoop the field?

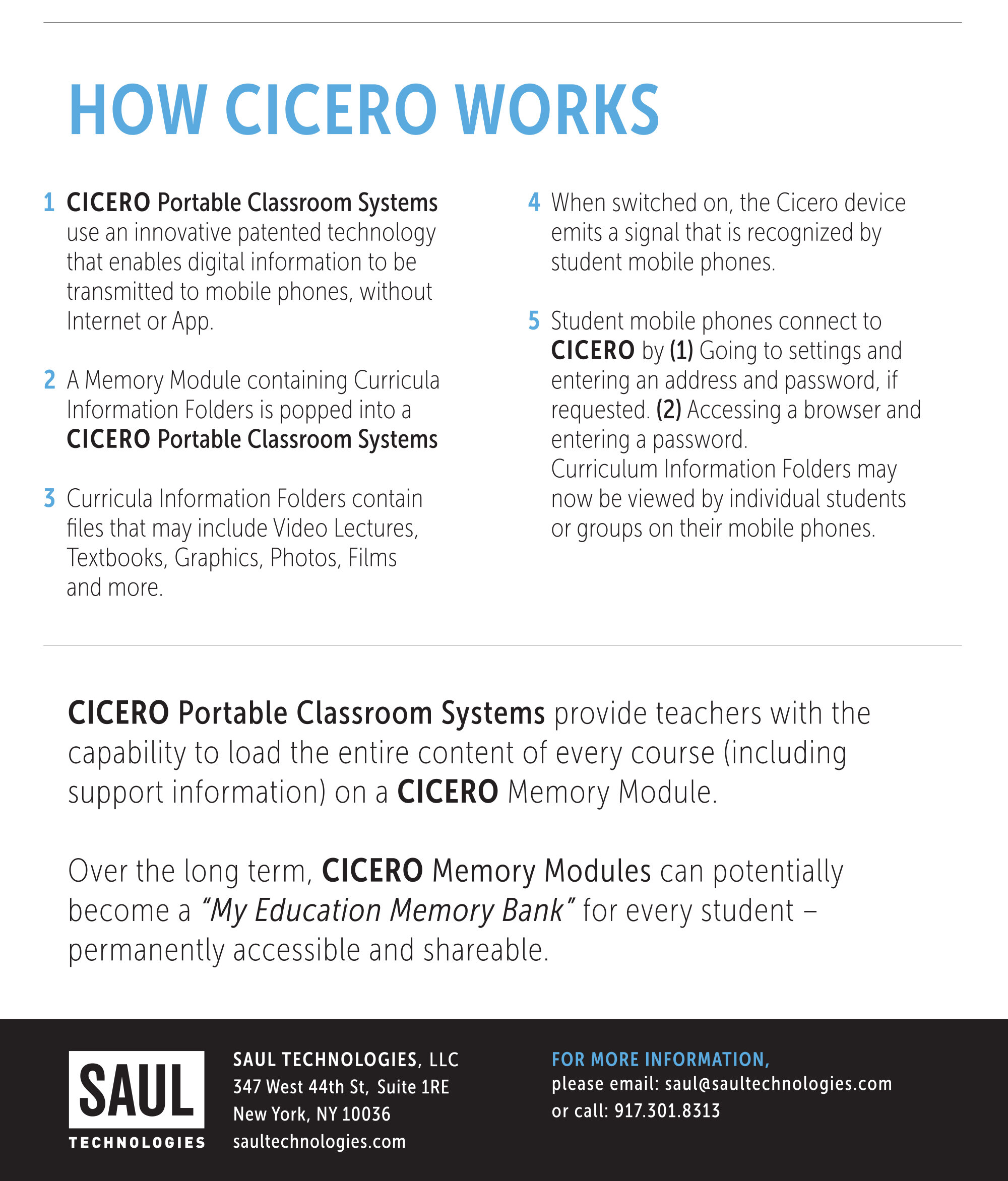

Incorporating Saul Technologies’ patented Chipserver® technology, the Safe Deposit Box for Data device allows the user to privately and securely share information in any form, anytime, anywhere, with no Internet or Bluetooth connection or app – with individuals or groups of any size – within a radius up to 50 feet. Unlike AirDrop or any other form of data transmission, with Chipserver technology, information can be accessed and viewed undetectably – without being downloaded – keeping it completely under the radar and off the digital grid, out of reach of hackers.

With the Safe Deposit Box for Data, confidential financial information -- bank accounts, tax returns, investments, credit cards, contracts (as well as personal medical records) -- can be safely, securely and undetectably locked down and shared privately with designated people and is incapable of monitoring the user’s location.

“Fraud prevention, privacy protection and data security are three of the biggest pain points in banking. Millions of bank customers’ records have been hacked over the years at great cost to both banks and consumers,” says Prof. Saul Troen, creator of the Chipserver technology and Safe Deposit Box for Data.

“What we’re seeing from banks are rather weak attempts to address these issues. For example, one major international bank (CitiGroup) is currently running an ad campaign focused on advising customers to watch out for misspellings as a sign of potential fraud. (Seriously?) “The first bank to offer the Safe Deposit Box for Data will take the lead in fraud prevention and privacy issues and gain an immediate and decisive competitive advantage in the banking world globally.”

Saul Technologies will give its first bank customer branding exclusivity for six months before making it available to banks everywhere. The plan calls for banks to provide it as a complimentary benefit to all of their customers who will receive an introductory package containing a Safe Deposit Box for Data device, three blank memory modules, and an instruction booklet.

Chipserver technology is the brainchild of Troen. As a professor of Biblical Archaeology at Hunter College in New York City, Troen takes many trips with students and other groups to places in the middle of nowhere where there is no internet access – such as the ancient Roman Roads in the Negev desert. Motivated by this need to teach with no internet, Troen worked with a software developer to create this new internet-independent technology.